Home Possible Income and Property Eligibility Guidelines

Table of Content

- Do HomeReady and Home Possible have any special rules after closing?

- Mortgage income requirements in 2022

- The Latest Boost For Affordable Housing: Gse Loan Limits Now Above $1 Million

- Are There Freddie Mac Programs For Low

- State Income Tax In Nevada

- What are home possible loans?

- Eligibility Requirements for Home Ready & Home Possible Loans

But any source of income must meet certain guidelines to qualify on a mortgage application. One way lenders determine affordability is by looking at your debt-to-income ratio . DTI compares your existing monthly debts with your monthly income. This shows how much money you have “left over” each month for a mortgage payment.

USDA-financed properties are generally capped at 2,000 square feet, with a guideline minimum of 400 square feet. Self-employment guidelines require a two-year history, along with a year-to-date profit and loss analysis and proof the business is still operating. The USDA requires documentation of employment for all adult members of a household.

Do HomeReady and Home Possible have any special rules after closing?

It’s the perfect program forfirst-time homebuyers; however, previous homeowners can apply as well. In order to qualify, you’ll need to make no more than 80% of the area median income. There are also similar programs available if you’re looking to refinance with a lower income and higher DTI ratio. A major benefit of FHA loans is that they only require a median 580 credit score if you have a sufficiently low debt-to-income ratio . The good news is that mortgage insurance on 1-unit properties can be canceled after your loan balance drops below 80% of the home’s appraised value and cancellation criteria are met. Also, mortgage insurance coverage requirements are lowered for LTV ratios above 90% (meaning you put down 10% or more).

It really is essential to talk to a lender to find out all the first-time home buyer loan options you can qualify for. Getting pre-approval on a loan is a great first step toward buying a home. It may feel overwhelming, but that’s when using a trusted mortgage lender like Mares Mortgage can really help. The first thing you will want to do is apply for a mortgage pre-approval. To apply, talk to your lender, and they will assess how much they will lend you based on your income, credit score, and assets.

Mortgage income requirements in 2022

While other programs like USDA Home Loans are for homes in rural areas. This home affordability calculator is a useful tool that helps you determine the income required for a mortgage and the overall cost of homeownership at today’s mortgage rates. This includes your loan principal, interest rate, property taxes, and homeowners insurance — commonly referred to as PITI. However, if another borrower earning the same income doesn’t have a car loan, a student loan, or credit card debt, they might be able to afford a mortgage payment of up to 28% of their gross income. So basically, a lower debt-to-income ratio increases your purchasing power, allowing you to get more house for your money.

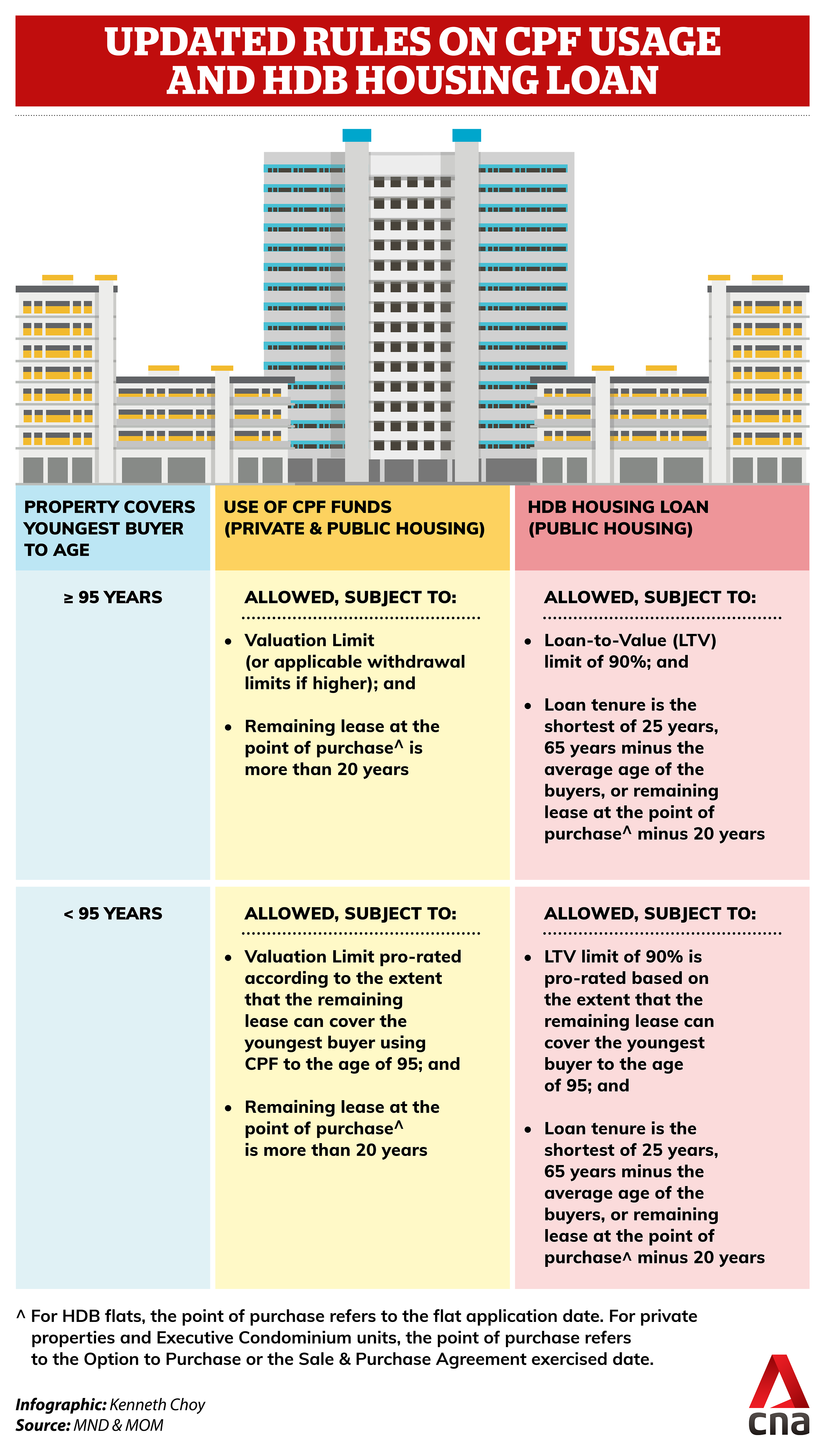

This helps the lender know that the development is in good condition, doesn’t have large investors owning multiple properties, and that the association is not under any litigation. The loan-to-value ratio is a lending risk assessment ratio that financial institutions and other lenders examine before approving a mortgage. Freddie Mac’s Home Possible was designed to help low-income families reach the goal of homeownership . It offers a low down payment requirement and more affordable fees.

The Latest Boost For Affordable Housing: Gse Loan Limits Now Above $1 Million

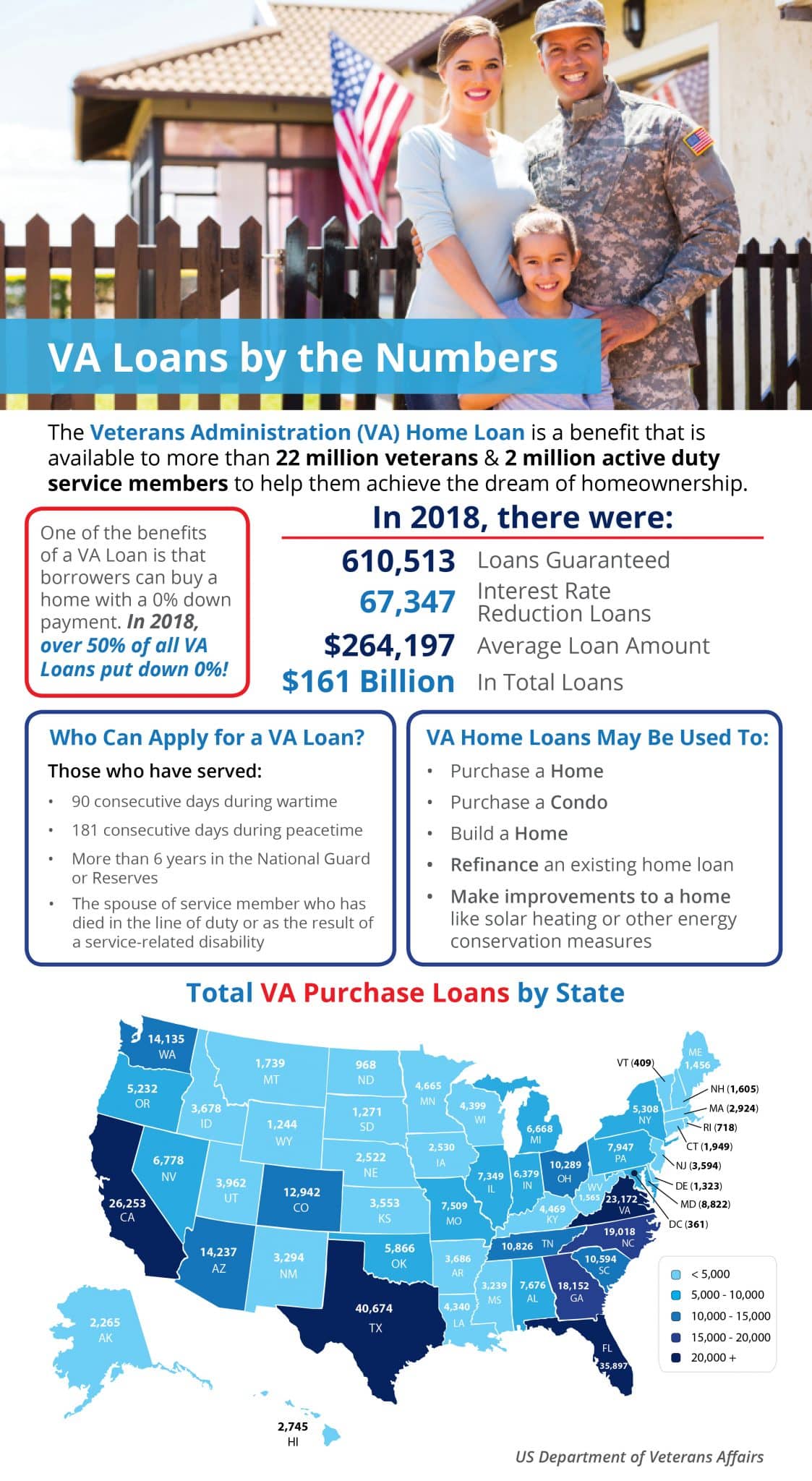

This gives military borrowers an edge over non-military borrowers who may need complicated and pricey jumbo loans to buy homes in expensive parts of the country. The Freddie Mac Home Possible program makes it easier for low to moderate-income families to buy a home. With just 5% down on the home, you may qualify for the loan with a debt ratio as high as 43%. As long as you have stable qualifying factors and can prove that you can afford the loan, you could be well on your way to home ownership.

Ⓡ are two options for government-sponsored mortgage programs. However, there are also other options from the FHA, USDA and VA. However, if your median credit score is 680 or better, there are no additional pricing adjustments on the loan.

Are There Freddie Mac Programs For Low

Fannie Mae and Freddie Mac share the goal of keeping mortgages affordable for the American people. Part of that initiative is Freddie Mac’sHome Possible mortgage program. Introduced in 2014, Freddie Mac’s Home Possible mortgage program is designed as a helping hand for prospective buyers who might not be able to secure a conventional mortgage. Bank of America offers a variety of mortgages, including low-down-payment loans. Existing BoA banking customers may get discounted interest rates. If you earn more than 115% of the median household income in your area, you won’t qualify for a USDA mortgage.

But you need to know that the better your score, the more flexible the requirements will be. And a high credit score will help you qualify for a better interest rate. In this article, we’ll cover first-time home buyer loan requirements and answer several common questions for first-time home buyers.

SoFi is an all-digital lender that offers conventional and jumbo mortgages, but no government-backed loans. Single-family homes, manufactured homes and condos in rural-designated areas can be financed with a USDA loan. Certain conditions apply to manufactured homes, and there are limits on how land can be used for producing income. The VA doesn’t set loan limits, which means VA borrowers may be able to buy higher-priced homes.

You’ll need a two-year history of employment, although VA-guidelines give some flexibility if your employer varies the income is stable and likely to continue in the future. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Use the income eligibility search tool to check on the limits in your state. If you’re buying an energy-efficient home, you may qualify with a debt ratio as high as 45% and a credit score as low as 580. Can prove their creditworthiness with alternative data. For example, lenders may accept 12 months of consecutive, on-time rent payments, along with utility bills and car insurance payments, to prove your history of paying bills on time.

However, you may be able to use other forms of down payment assistance. Fannie Mae and Freddie Mac were chartered separately by Congress in 1938 and 1970 before being spun off into shareholder-controlled companies. Currently, they’re government-sponsored entities under the Federal Housing Finance Agency. Although founded at different times, they have a shared mission of providing mortgage funds that are affordable for the general public. According to Freddie Mac’s requirements, you’ll need a FICO score of 660 or higher to qualify for a Home Possible loan. Planet Home Lending is an approved Freddie Mac Home Possible® lender.

What are home possible loans?

Standard conventional loans, VA loans, and FHA loans don’t have income limits. But household income limits are typical with USDA loans and some specialized programs. FHA loan guidelines set the lowest minimum credit score requirements of any standard loan program, allowing scores as low as 500 with a 10% down payment.

When researching mortgage options, you’ll quickly realize the down payment requirements on Home Possible mortgages offer a clear advantage. On a typical home loan, buyers would have to hand over at least 20% of the sales price for a down payment in order to avoid any mortgage insurance requirements. Home Possible loans might come with stricter credit requirements than other mortgage assistance programs. If you apply with a credit score of 680 or higher, you can avoid additional lending expenses that come with other mortgage programs. FHA loan qualifications don’t usually require cash reserves unless you’re buying a two- to four-unit home or trying to qualify with a lower credit score. In the past, that meant a loan denial for a conventional loan.

Comments

Post a Comment